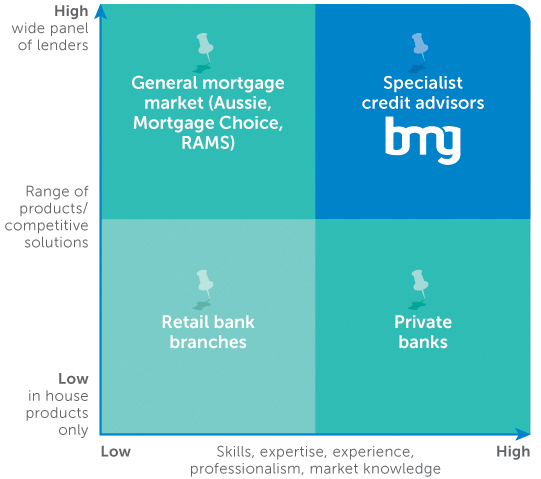

At BMG Financial Services we will take the time early to understand your needs and structure a financial solution that works for you. Your loan will be sourced from a panel of lenders to provide you with a wide range of choices to match your requirements.

With access to lenders ranging from the major banks and credit unions to smaller specialised lenders, we can provide the result you are looking for. Once you have made your selection we will manage the process from start to finish so your involvement is limited leaving you the time to get on with work, family or whatever you enjoy.

After our initial phone conversation, or consultation, we will already have a good idea as to how we can best service your needs and which lender, or lenders, will be able to accommodate your specific requirements whether it is for a residential loan, commercial loan or equipment finance.

With years of experience providing finance for a range of customers we have kept up with the ever changing banking market to ensure we can find you the right solution at the outset.

Our point of difference

What does our service include?

• Initial consultation to listen and understand your financing needs and goals

• Reviewing your financial position to ascertain capacity to borrow and ability to service debt

• Selecting products with interest rates and terms that match your borrowing requirements

• Presenting the most suitable financing options for you to consider and select from

• Assisting you with the completion of the application form ready for submission

• Lodging application form with the applicable lender

• Liaising with lender’s credit department through credit review process to successfully obtain approval

• After formal approval, the loan documents will be completed and forwarded for review and execution.

• The completed and signed documents are returned to the lender in readiness for settlement

• Settlement is finalised and funds are transferred

• Post-settlement implementation

Throughout this entire process we will be in constant contact with you and your legal representatives, as required. After settlement, we will regularly follow up to ensure that everything has been set up correctly and is operating smoothly.

> Why choose BMG

> Why use a broker?

> What to look for in a broker

Follow Us!